Symbiosis School of Banking and Finance (SSBF), one of the prominent B-schools in the BFSI (Banking, Financial Services and Insurance) domain and a constituent of the renowned Symbiosis International University, is set to close applications for its flagship MBA in Banking and Finance programme’s next batch 2023-25 intake. Aspirants who have registered and appeared for Symbiosis National Aptitude Test (SNAP) 2022 can apply for the programme by visiting the SSBF’s official website till 16th January 2023. A valid SNAP score is a mandatory pre-requisite to seek admission to MBA in Banking and Finance at SSBF.

As the next step, shortlisted SNAP aspirants would be required to appear for the Group Discussion, Personal Interaction, and Written Ability Test (GE-PIWAT). The final selection of candidates for the MBA (Banking and Finance) programme will be based on the cumulative marks scored on 100 marks, out of which the SNAP score will be scaled down to 50 marks, and the remaining 50 per cent weightage will be ascertained from the Group Discussion, Individual Interaction and the Written Ability Test.

Aimed at developing future BFSI leaders, SSBF’s MBA in Banking and Finance relies on a robust curriculum and collaborative initiatives for holistic learning that transforms into in-demand problem-solving and decision-making skills. Focussed equally on policy formulation and economic growth, the curriculum for the two-year full-time residential programme cuts across advanced modules to understand the dynamic Indian and global BFSI environment.

Further, a strong placement record with prominent companies such as JP Morgan, CRISIL, Credenc, ICICI Bank, Kotak Mahindra Bank, and many more help strengthen the alumni base at SSBF annually and also offer networking opportunities to aspiring students. Witnessing stellar placement records, the 2021-23 batch of SSBF secured the highest package of 19.59 LPA and an average package of 11.21 LPA.

The cohort of 90 students also undergo an in-depth understanding of concepts, tools, and techniques relevant to management and related disciplines to be able to function effectively as an individual, as a member or leader in diverse teams, and in multidisciplinary settings. Addressing the need for specialists in the BFSI sector, students at SSBF learn Finalytics, Financial Engineering and Analytics, Alternate Asset Management, FOREX and Treasury Management, Technology in Financial Markets, Derivative Markets, Mergers & Acquisitions, Portfolio Management, Corporate Governance and Ethics, among others. With 100 credits spread across four semesters, students of MBA in Banking and Finance learn a host of courses along with the opportunity to select an elective in Leadership and Capacity Building, Financial Engineering and Analytics and Digital Marketing.

Implementing a wide range of learning methods such as group discussion, case studies, presentations, analytical sessions, seminars and formal lectures, the overall pedagogy comprises theory through simulations and experiential learning. Moreover, the access that the institute provides to different databases and software, such as Bloomberg, R, SPSS, and GIEOM, fast tracks the progress of the candidates from students to professionals. Additionally, immersion in eminent institutes worldwide via Summer and Winter schools combined with mentorship by industry leaders and industry exposure help students develop a holistic understanding from both theoretical and practical standpoints.

To nurture and guide young professionals and students, the institute organizes an annual ‘BFSI Leadership Summit’ where thought leaders gather to share ideas on leadership in the BFSI sector. The students also get to attend several symposiums, field projects and ISR events conducted by the institute at regular intervals.

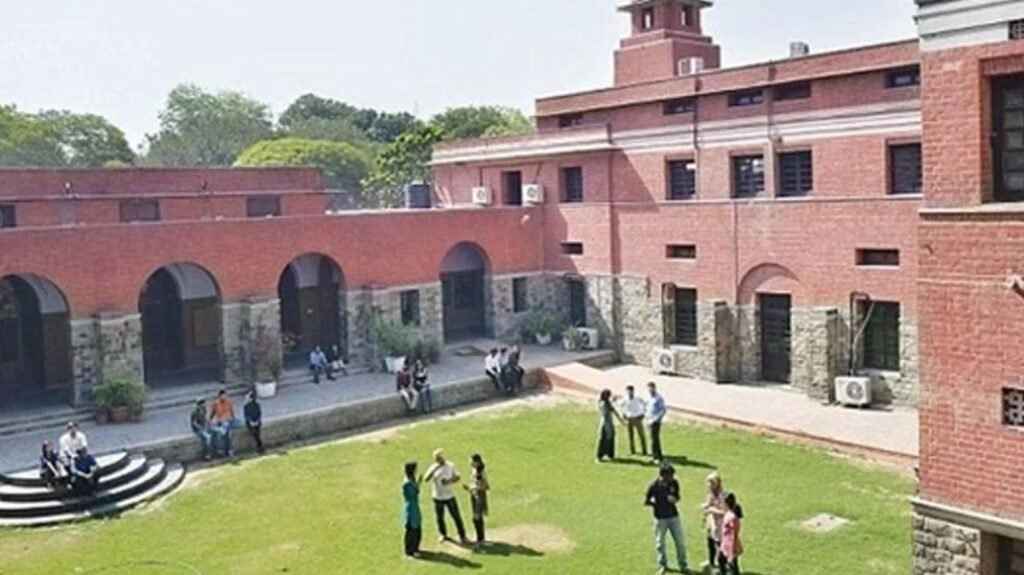

Apart from its education and placement offers, SSBF prides itself on a world-class and smart infrastructure which contributes towards the high-quality life on campus and enhances the study environment for the candidates. Life at the campus is marked by the diversity of cultures brought together by the institute. This exposure furthers the goal of the institute to create socially responsible leaders.